Alternative Investments

Unleashing the Potential of Alternative Investment Strategies

Experience a new paradigm in wealth management with our cutting-edge alternative investment strategies. We understand that traditional approaches to investing may not always provide the desired outcomes. That’s why we’re here to introduce you to a universe of opportunities that can help you help increase returns, manage risk, and diversify your portfolio.

In today’s ever-changing market, it’s crucial to explore innovative approaches to wealth management. Alternative investments offer a multitude of advantages that can amplify your portfolio’s performance and safeguard your assets. By going beyond conventional methods, you can discover a world of possibilities that lie beyond the reach of mainstream investments.

Why Consider Alternative Investment Strategies?

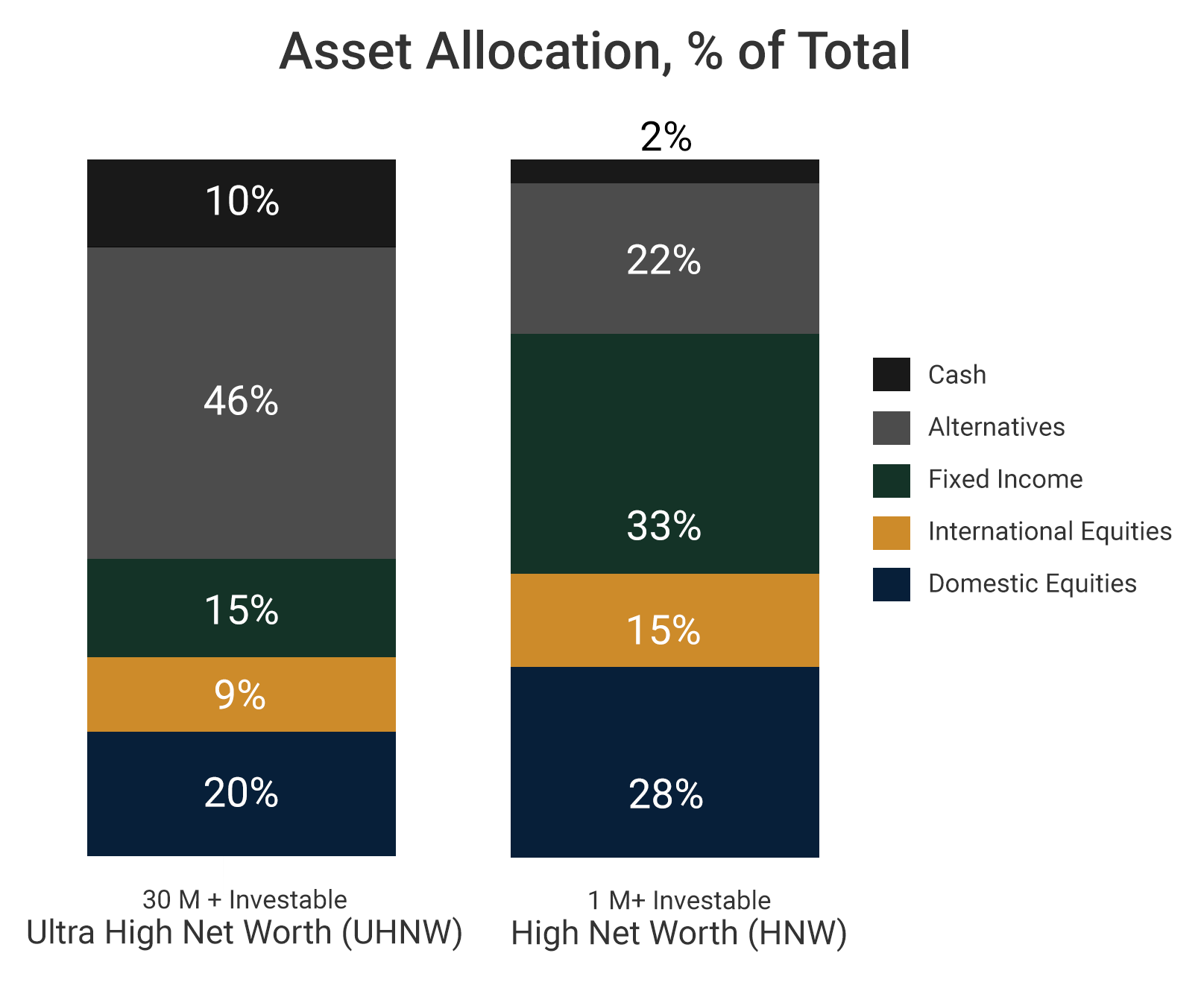

Enhanced Diversification: Conventional investments can be highly correlated, making your portfolio vulnerable to market downturns. By incorporating alternative investments such as real estate, private equity, hedge funds, and commodities, you can pursue a greater level of diversification and reduce exposure to market volatility.

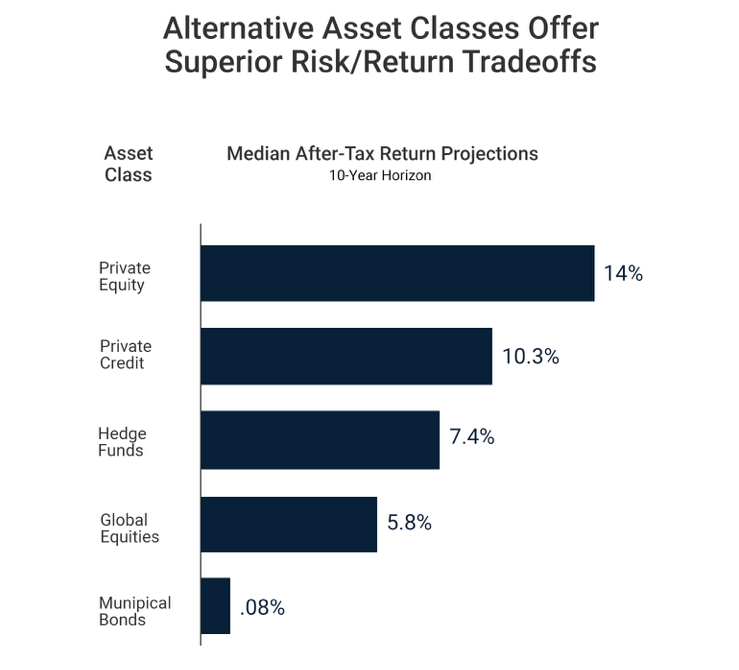

Potential for Higher Returns: Alternative investments often operate in less efficient markets, allowing skilled managers to uncover hidden opportunities and generate attractive risk-adjusted returns. By accessing these specialized investment vehicles, you can aim to outperform conventional asset classes and unlock the potential for substantial gains.

Risk Mitigation: In today’s uncertain world, managing risk is paramount. Alternative investments can act as a hedge against market fluctuations and provide confidence during economic downturns. These strategies offer the potential to lower overall portfolio risk and increase resilience, safeguarding your wealth from unforeseen events.

Long-Term Wealth Preservation: Alternative investments offer unique features that are well-suited for long-term wealth preservation goals. Whether you seek income generation, capital appreciation, or legacy planning, our alternative investment strategies can help you achieve your specific objectives while mitigating risks along the way.

Why Choose Us?

We are committed to your financial success. Our dedicated team is passionate about staying at the forefront of alternative investment strategies, continually analyzing emerging trends and opportunities. When you partner with us, you benefit from:

- Specialization: Our team consists of seasoned professionals with deep knowledge and experience in alternative investments. We combine rigorous research, due diligence, and sophisticated analytics to design strategies that align with your unique financial goals.

- Customization: We recognize that every investor’s needs are different. That’s why we take a personalized approach to wealth management. We work closely with you to understand your aspirations, risk tolerance, and time horizon, tailoring our alternative investment strategies to suit your specific requirements.

- Unparalleled Access: We have established strong relationships with leading investment managers and industry experts worldwide. Through our extensive network, we provide you with access to exclusive opportunities that may not be readily available to individual investors.

- Transparency and Trust: We uphold the highest standards of integrity, transparency, and client-centricity. Your trust is our top priority, and we strive to build long-lasting relationships founded on open communication, ethical practices, and putting your interests first.

Unlock the Power of Alternative Investments Today!

Don’t let your wealth be confined by traditional investment approaches. Discover the untapped potential of alternative investment strategies with us. Our comprehensive solutions could empower you to navigate the complexities of the financial markets and achieve your long-term financial objectives.

Take the first step towards a brighter financial future. Contact us today and schedule a consultation with one of our expert advisors. Let us guide you on a path of wealth empowerment through alternative investments. Together, we will unlock new horizons of prosperity for you and your family.