What is the New Jersey Secure Choice Savings Program?

The New Jersey Secure Choice Savings program is a state sponsored retirement plan designed to help employees put money aside for retirement. This program will require any New Jersey business with 25 of more full or part-time and have been in business for the last two years to either adopt a 401(k) plan or enroll in the state-run plan. For those employers who have 40 or more employees, your implementation deadline is September 15, 2024. Should you fail to register before June 15, 2025, you may be subject to penalties in accordance with the statute. For those employers who have 25-39 employees, your implementation deadline is set for November 15, 2024. Should you fail to register before August 15, 2025, you may be subject to penalties in accordance with the statute.

How does the New Jersey Secure Choice Savings Program work?

The New Jersey Secure Choice Program first auto enrolls employees at a 3% Pre-tax contribution rate into an individual retirement account (IRA) through payroll deductions. Employees can opt out or increase/decrease their contribution rate into the account. Unlike a 401(k) plan where employees can contribute on a Pretax or Roth basis, the Secure Choice program only allows for Pretax deferrals. Additionally, contributions into the Secure Choice program are limited to $7,000 maximum ($8,000 for those over 50), while a 401(k) plan will allow employees to defer up to $23,000 or $30,500 if over age 50, for 2024.

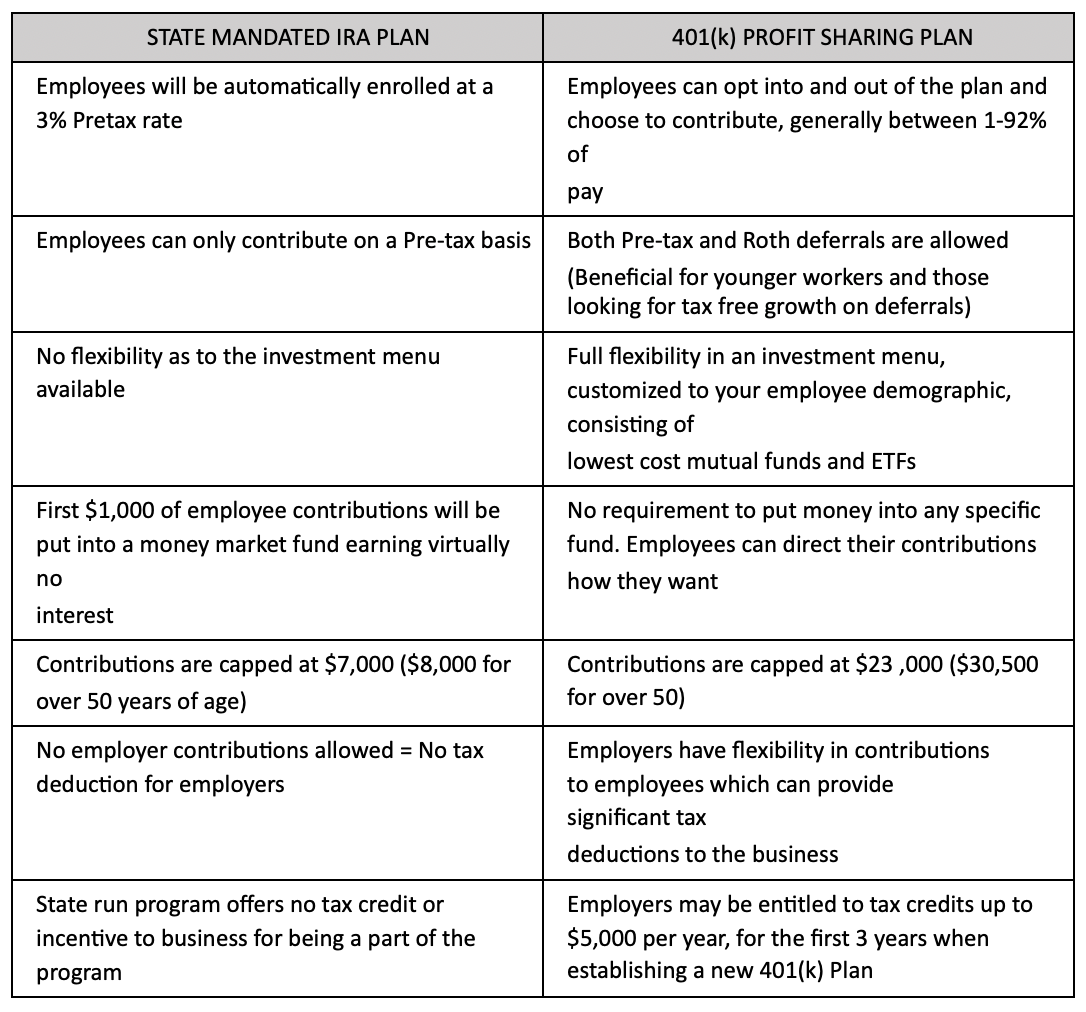

Employers are also limited when it comes to the Secure Choice Program as they are not allowed to offer matching contributions or Profit-Sharing allocations into the plan. Some employers who are looking for a benefits package to retain and reward employees, as well as take advantage of the tax deductions offered by making employer contributions will be unavailable. Additional differences between the state mandated program and a 401(k) Profit Sharing plan are outlined in the chart below.

What are the investments offered in the NJ Secure Choice plans and how are they managed?

The fund offerings and the firm(s) managing these investments have not been announced even at this time providing uncertainty to employees. From Section 11 of Bill A4134, the following points have been released:

- The board shall establish as an investment option a life-cycle fund with a target date based upon the age of the enrollee. This fund shall be the default investment option for enrollees who do not elect another investment.

- The board may establish any or all of the following investment options:

- Conservative principal protection fund

- A growth fund

- A secure fund whose primary objective is the preservation of the safety of principal and

the provision of a stable and low-risk rate of return - A capital preservation fund that prioritizes the security of the deposit over the rate of

return* - An annuity fund**

- A life-cycle fund or any other investment option deemed appropriate by the board

- The board shall not offer more than 5 investment options in any given calendar year

With a 401(k) plan and working with our retirement plan team, we can create a lineup of about 20-25 different investment options tailored to your company’s employee demographic with various risk-return characteristics. Employees will be offered Target Date life cycle funds, as well as growth, value, capital preservation and fixed income options. Additional specialty sectors such as Real Estate, Gold & Precious Metals, Technology focused, Agriculture and Utilities can be added to your plan’s lineup as well, providing a diverse range of investment choices for plan participants.

*If the board elects to establish a capital preservation fund, it may stipulate that the first $1,000 in contributions shall be deposited into this fund.

**An annuity fund may require a lock-up or holding timeframe in which the employee may not be able to change or move money out of the fund for a determined period of time.

Are there penalties if an employer does not comply?

According to the language in the legislation, New Jersey businesses that do not adhere to the state-mandated guidelines within one year (March 28, 2023), will receive a written warning from the state government. Each subsequent year of non-compliance will result in the following penalties:

- 2nd year: $100 per employee

- 3rd and 4th years: $250 per employee

- 5TH year and beyond: $500 per employee

- An employer who collects employee contributions but fails to remit any portion of the contributions to the fund shall be subject to a penalty of $2,500 for a first offense, and $5,000 for the second and each subsequent offense.

What role will employers have to play in the administration of the NJ Secure Choice program?

Administration of the NJ Secure Choice plan to ensure compliance with the law can be very burdensome on employers, who must:

- Track eligibility status for all employees

- Provide program information to all current and new employees

- Enroll new employees within three months of their date of hire

- Track and honor opt out requests

- Automatically withhold three percent of pretax earnings for those who don’t opt out

- Deposit retirement benefit deductions with the state

- Offer an annual open enrollment period

- Submit an employee census to Secure Choice annually

By choosing a 401(k) plan, our team can design a plan with our TPA (Third Party Administrators) and platform partners so that employers can focus on running their business and our team and partners will focus on administration of your company plan.

Differences between NJ Secure Choice Program and a 401(k)/Profit Sharing Plan

This material and the opinions voiced are for general information only and are not intended to provide specific advice or recommendations for any individual or entity. To determine what is appropriate for you, please contact your Financial Professional. Information obtained from third-party sources are believed to be reliable but not guaranteed. The tax and legal references attached herein are designed to provide accurate and authoritative information regarding the subject matter covered and are provided with the understanding that Eagle Rock Wealth Management Inc and Greenberg & Rapp Financial Group, Inc., are not engaged in rendering tax, legal, or actuarial services. If tax, legal, or actuarial advice is required, you should consult your accountant, attorney, or actuary. Eagle Rock Wealth Management Inc and Greenberg & Rapp Financial Group, Inc., do not replace those advisors. Securities and investment advisory services offered through M Holdings Securities, Inc., a Registered Broker/Dealer, Member FINRA/SIPC. Eagle Rock Wealth Management Inc and Greenberg & Rapp Financial Group, Inc., is independently owned and operated. #4822362.1