Private Placement

PPLI, or Private Placement Life Insurance, is a powerful financial tool used by high net worth individuals to preserve and grow their wealth. Our video breaks down the complex concepts behind PPLI and presents them in a clear and concise manner. You’ll learn how PPLI offers tax advantages, investment flexibility, and asset preservation, making it an ideal solution for those who want to maximize their wealth management strategy.

Wealthy Americans are scrambling for places to hide from plans by Democrats to hike their taxes.

High-net-worth investors have more options when it comes to tax-saving moves than the…

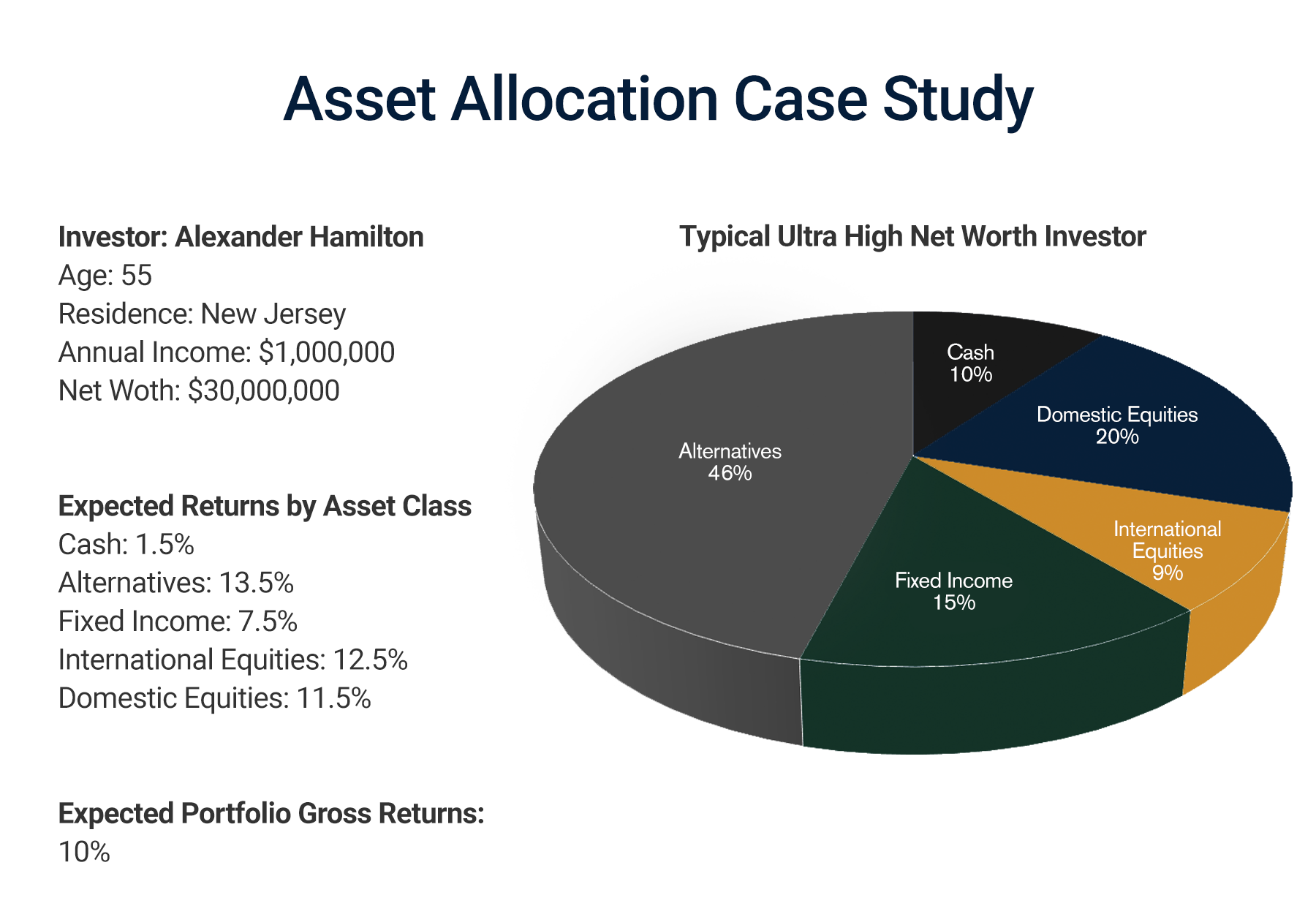

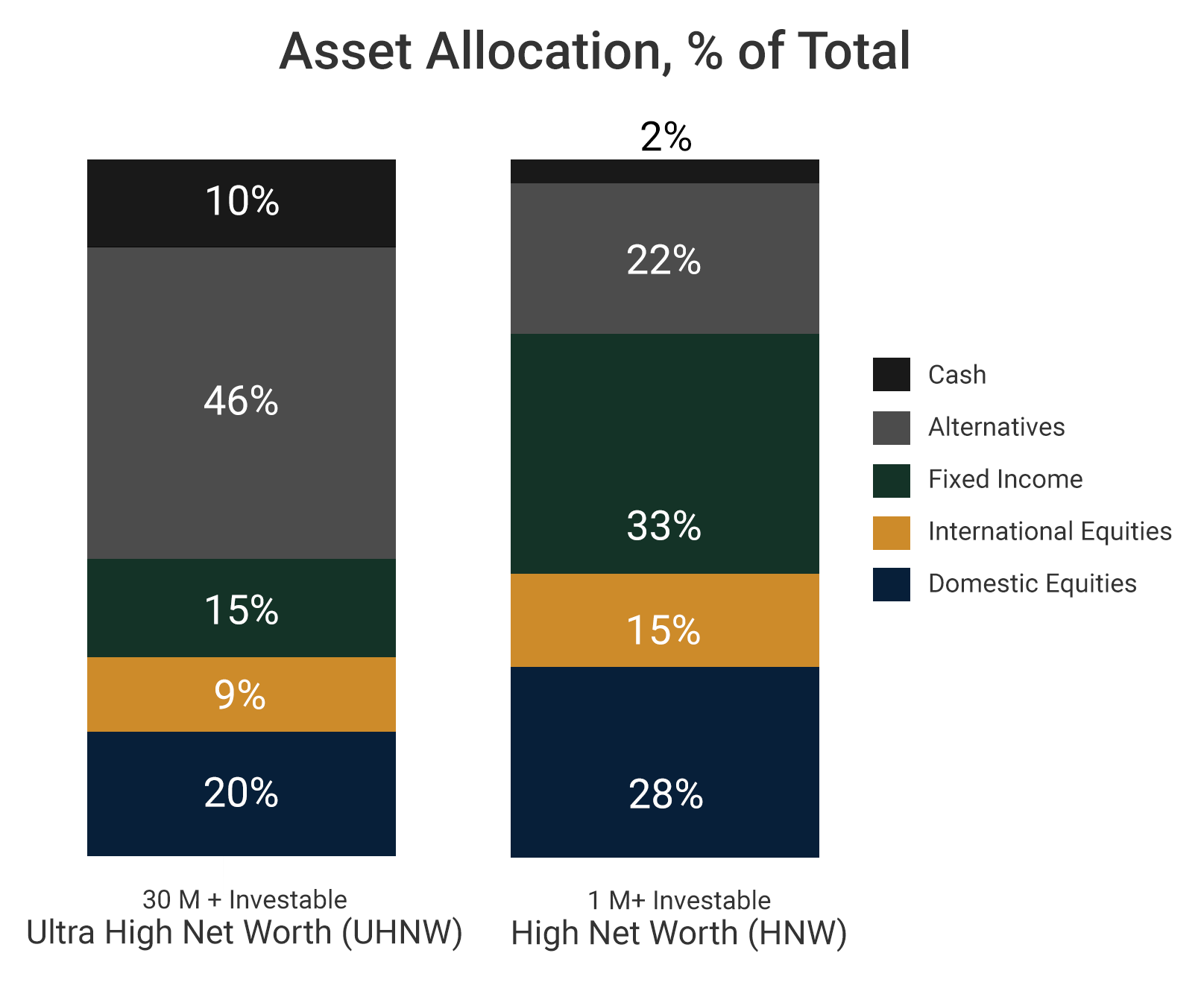

HNW families face unique challenges when it comes to managing their wealth.

Higher income and capital gains taxes are very likely as the federal government seeks ways to…

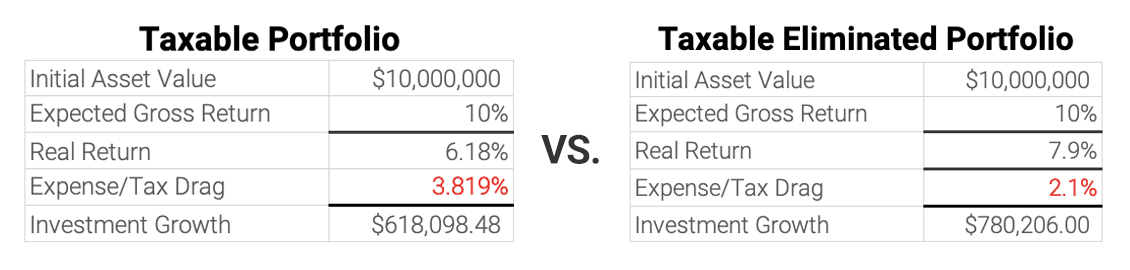

An effective way to achieve tax efficiency for this portion of their portfolios, and maintain a…

If any of these topics concern you, my team and I would be happy to talk and share our insights.

Thomas Rapp

67 East Park Place, Suite 750

Morristown, New Jersey 07960

Cell: (201) 602-7871 | Office: (973) 434-8077

Private Placement Life Insurance (PPLI) is a tax-reducing investment strategy that gives sophisticated investors access to any asset class and investment strategy without the performance drag of income / capital gains taxes.

Private Placement Variable Annuity (PPVA) is a tax-advantaged investment strategy that gives sophisticated investors access to any asset class and investment strategy while deferring taxation for decades. This strategy is particularly valuable for the elderly / uninsurable or families with charitable foundations.

Private Placement Life Insurance is an unregistered securities product and is not subject to the same regulatory requirements as registered variable products. As such, Private Placement Life Insurance (or Annuities) should only be presented to accredited investors or qualified purchasers as described by the Securities Act of 1933.

Tax Alpha

When it comes to investing, wealth is a double-edged sword. Wealth gives you access to world-class investment options and sophisticated managers but also guarantees returns will be devastated by taxes every year. These burdensome tax losses should be continuously compounding for the benefit of your children but instead are removed from the equation each year. Over a lifetime of investing we believe taxation is the largest component of return variation for the ultra-high-net-worth.

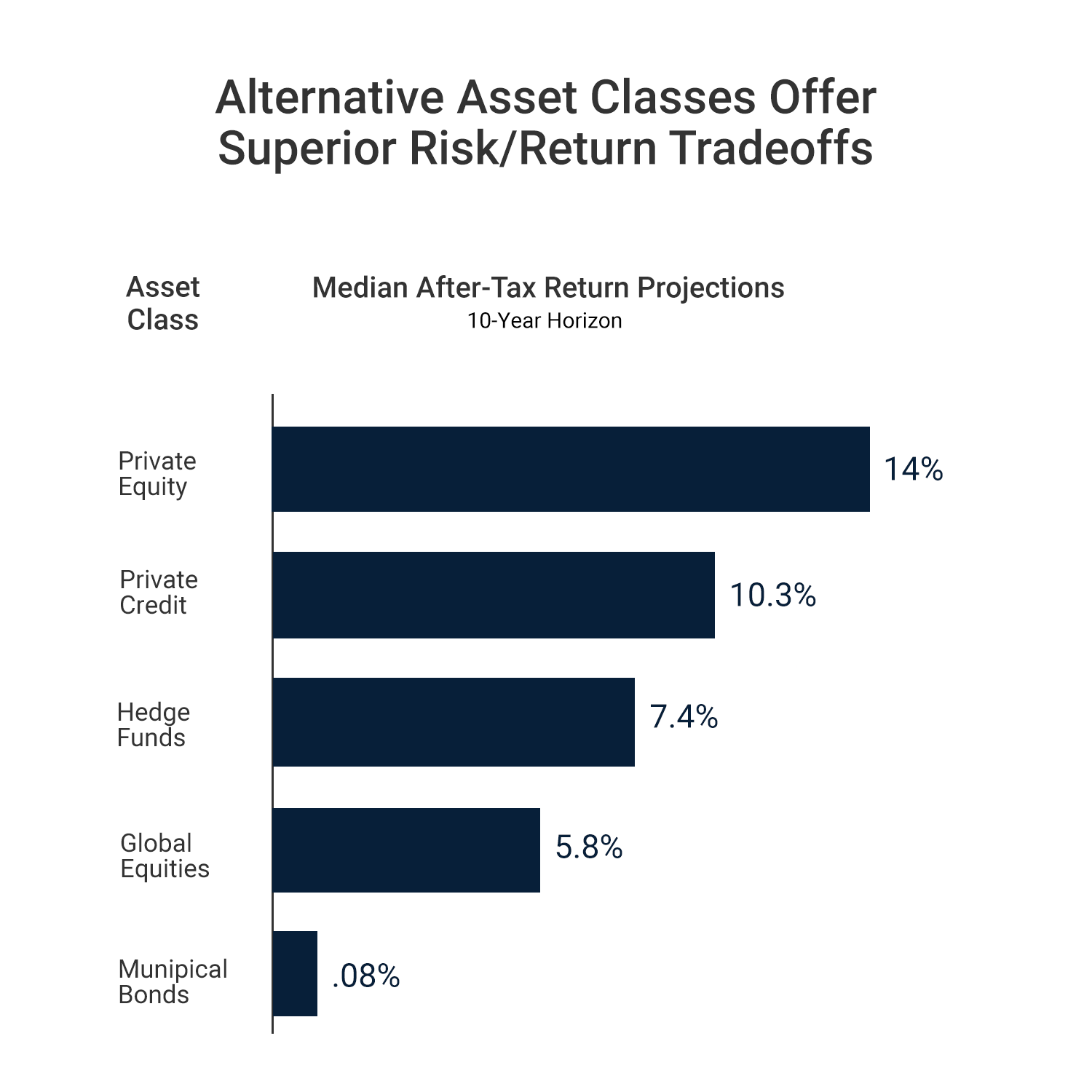

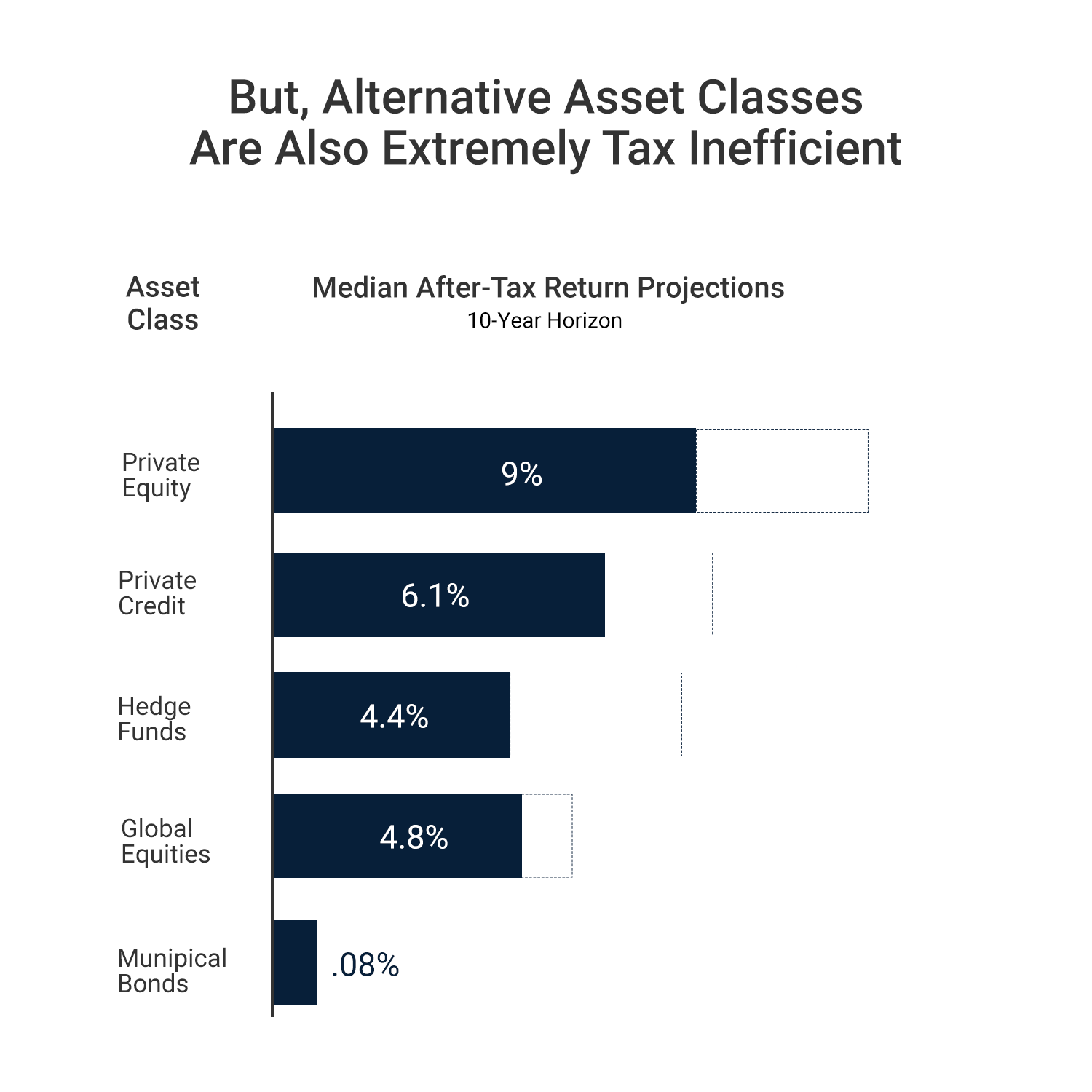

Ultra-high-net-worth investors have access to the best private equity and hedge funds in the world. Research shows that wealthy investors hold 25% and 50% of their investable capital in alternative funds like these.

Sophisticated investors prefer these types of assets over traditional retail options because of their potential for superior returns.

Unfortunately, superior returns also come with greater tax inefficiency creating a major problem for families trying to build a legacy that lasts forever.